Gross income calculator yearly

To calculate gross pay for a salaried employee take their total annual salary and divide it by the number of pay periods within the year. Sara works an average of.

Salary Formula Calculate Salary Calculator Excel Template

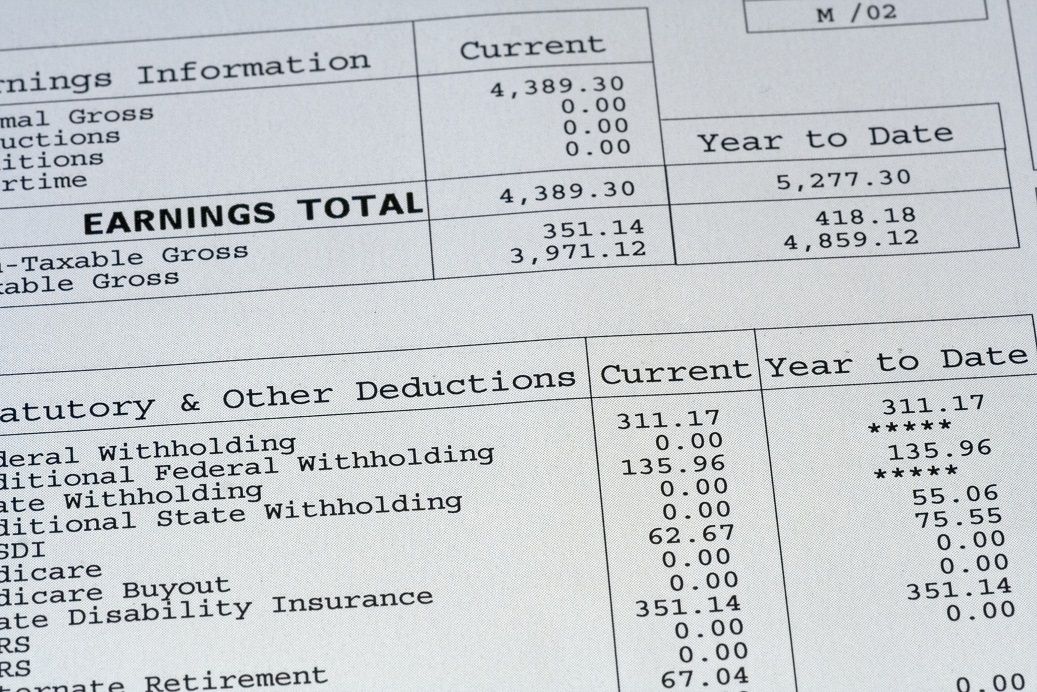

Adds all the amount form the deductions.

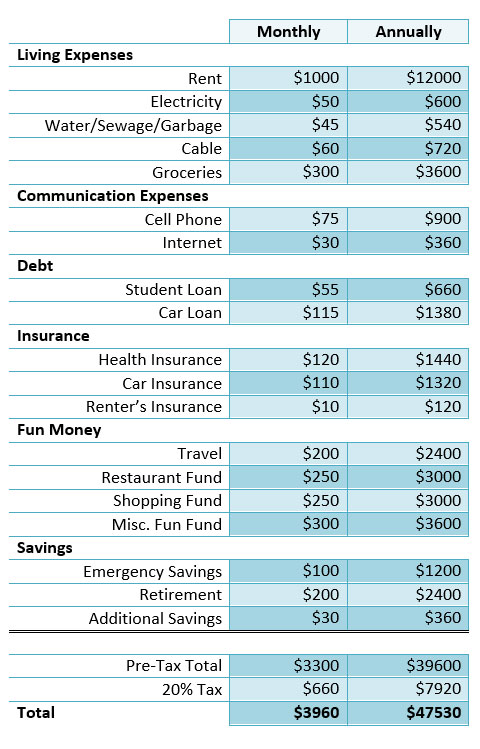

. You can use our Monthly Gross Income calculator to determine your gross income based on how frequently you are paid and the amount of income you make per pay period. How to calculate annual income. That means that your net pay will be 43041 per year or 3587 per month.

Adds all the values from the income sources specified. If the amount shown is. This calculator calculates the gross income to net income.

AGI gross income adjustments to income Gross income the sum of all the money you earn in a year. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The PAYE Calculator will auto calculate your saved Main gross salary.

The result is net income. This calculator will help you to quickly convert your annual salary into the equivalent hourly income. Annual Salary Hourly Wage Hours per workweek 52 weeks.

The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. The adjusted annual salary can be calculated as. The calculator calculates gross annual.

A pay period can be weekly fortnightly or monthly. If a business pays its employees once a. For example if an.

The formula of calculating annual salary and hourly wage is as follow. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. Your average tax rate is.

Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of. Quarterly Salary Annual Salary 4. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

The annual income calculation used in this calculator is based. It can be used for the. Calculator for the gross annual income Gross income is before tax.

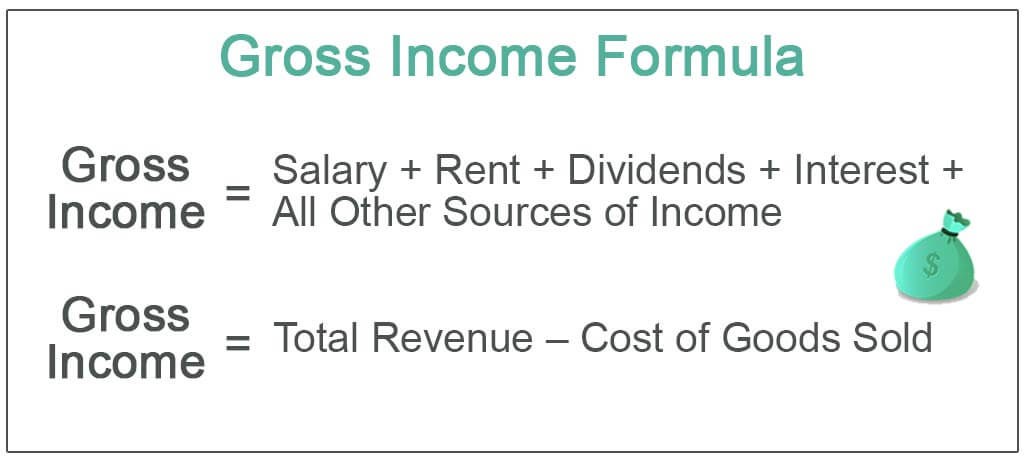

You can calculate your AGI for the year using the following formula. Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage Example Lets calculate an example together. Simply enter your annual income along with your hours per day days per week work.

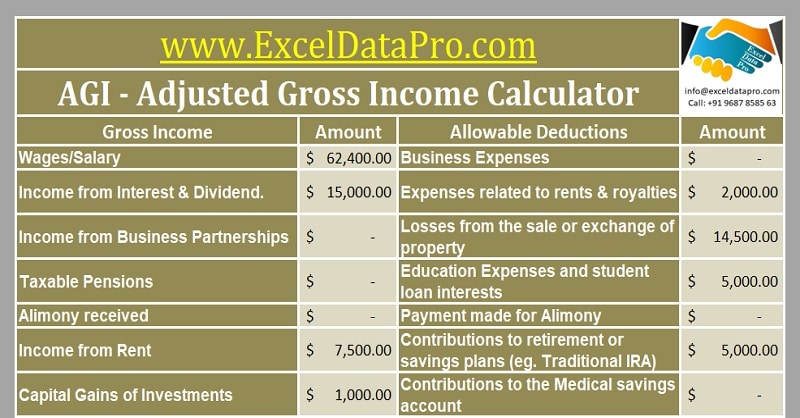

When filling out your application youll be shown the expected yearly income. Write down the net expected income for coverage year or download and save the PDF. The algorithm behind this adjusted gross income calculator performs the following steps.

Youll then get a breakdown of your total tax liability and take. 30 8 260 - 25 56400. This annual income calculator finds out how much you make per year by calculating your annual income from your hourly wage.

It can be any hourly weekly or annual before tax. Estimated number of hours worked per week x hourly rate x 52 gross annual income The 52 represents the number of weeks you work throughout the year. You can change the calculation by saving a new Main income.

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

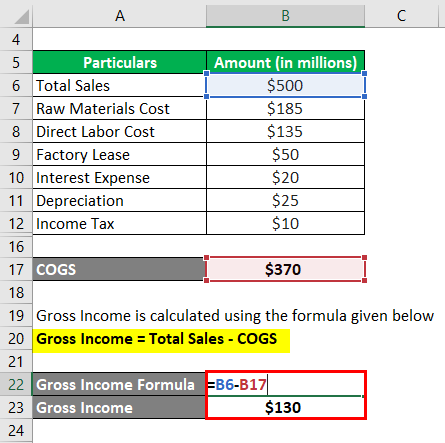

Gross Income Formula Calculator Examples With Excel Template

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Annual Income Definition Calculation And Quiz Business Terms

Gross Pay Definition Components And How To Calculate

Annual Income Calculator

Gross Income Formula Step By Step Calculations

Income 5 Easy Ways To Calculate Your Annual Income

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

4 Ways To Calculate Annual Salary Wikihow

Gross Income Formula Calculator Examples With Excel Template

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Gross Income Formula Step By Step Calculations

How To Calculate Gross Income Per Month

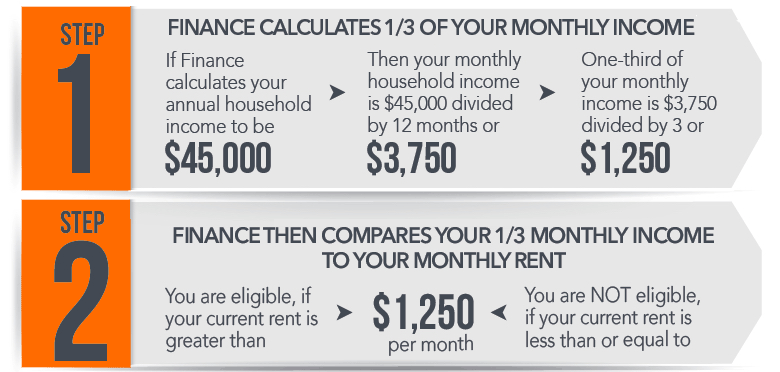

Calculating 1 3 Of Your Income

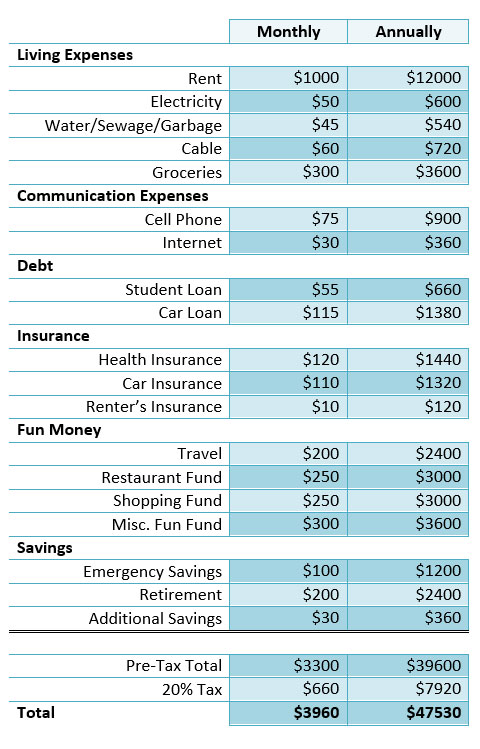

How To Calculate How Much You Need To Earn